We have come to espouse a world that is witnessing change at an accelerated pace. Correspondingly, our personal circumstances, needs, and goals are also undergoing a shift and becoming more nuanced. In the backdrop of such a landscape, astute financial planning can play a key role in helping you achieve financial stability and accomplish your long-term goals. From that perspective, it would be interesting to understand how investors are navigating the current landscape and gearing up to secure their future.

Riding the wave: A glimpse into Indian stock market growth

While the stock markets are known to witness periodic ebbs and flows, it is widely accepted that over the long-term they have the potential to create investor wealth. This is also evidenced by the returns generated by the stock market and the corresponding wealth creation. According to the Bloomberg LP Global Wealth Blueprint report, a significant 84% of affluent investors have witnessed a surge in their net worth over the past three years. While acknowledging that economic volatility poses challenges, only 39% of respondents believe that it will significantly impact long-term wealth creation. Further, 35% view the current situation as an opportunity to enhance their financial standing.

Diversification trends: Beyond conventional investments

The age of convention of avoiding putting all your eggs in one basket is well-practices in financial planning. Most investors understand the importance of creating well-diversified portfolios. However, with needs becoming more nuanced and accelerated product side innovation, investors are increasingly gravitating towards alternative investment options like INviTs, REITs, private credit opportunities (performing credit) and gold. These investment opportunities have a differentiated risk-return profile compared to traditional assets and can provide diversified exposure, thereby enhancing the overall risk-adjusted returns of investor portfolios.

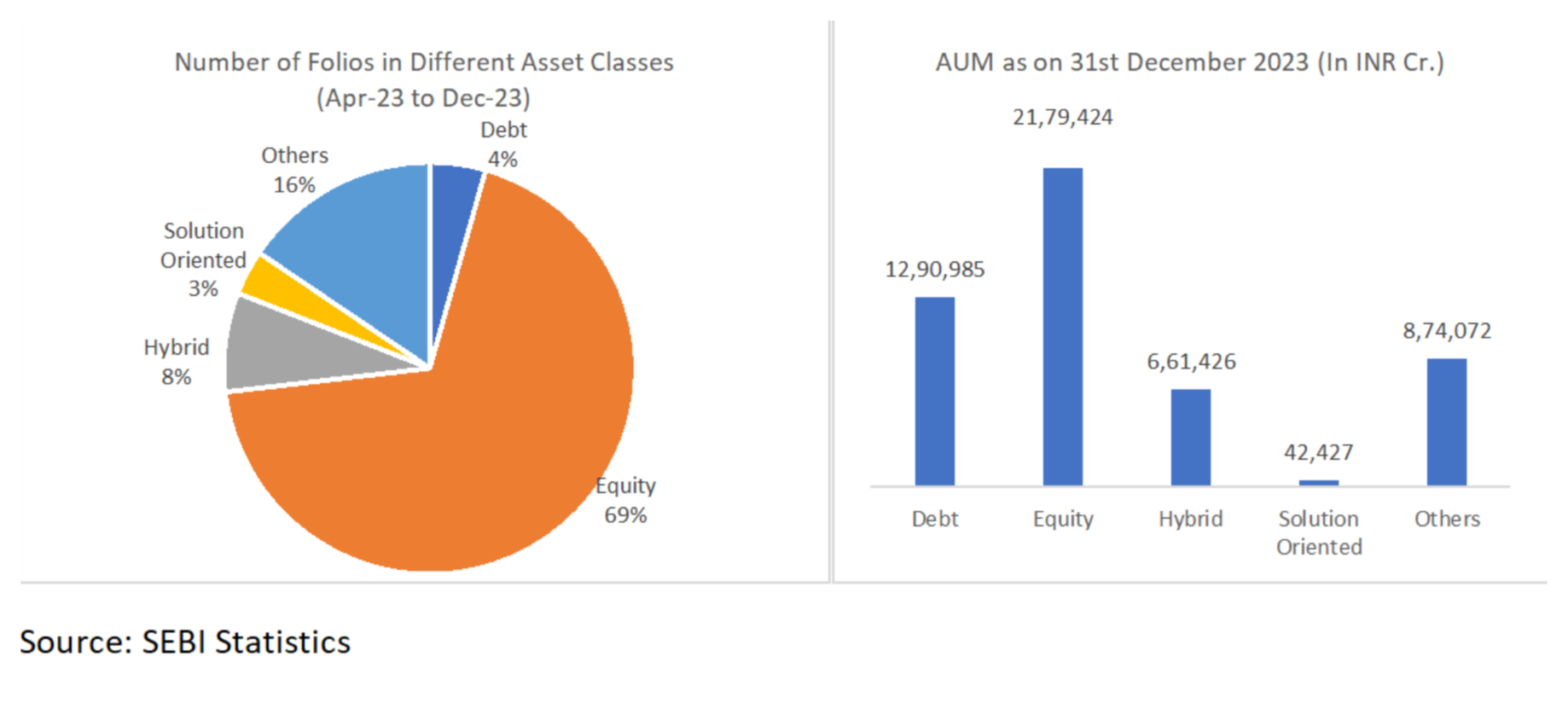

By the numbers: Mutual fund landscape

The mutual fund industry in India has been growing at a strong clip with growth in both the Assets Under Management (AUM) and the number of folios. While the former stood at INR 50.78n lakh crore as on 31st December 2023, the latter was at 16.49 crores as of the same date. The below exhibits showcase the folio-wise and AUM-wise breakdown of various asset classes.

Embracing the future: Emerging investment trends

Embracing the future: Emerging investment trends

Investors are also becoming increasingly conscious of the impact of their investment decision on their ecosystems and are gradually shifting towards emerging ideologies such as Environmental, Social, and Governance (ESG) investing, digital infrastructure, and AI-oriented investment strategies.

Optimally harnessing the power of compounding: One of the key tenets of wealth creation is allowing the power of compounding to work its magic. Compounding, also known as the eight wonder of the world, is a mathematical concept that allows you to earn returns on not just the amount invested but also on the returns generated from the investment. Compounding works best over the long-term and can play a significant role in wealth creation.

The road to financial success: A concluding note.

In conclusion, personal investment is a dynamic journey that requires careful planning, continuous learning, and disciplined execution. Diversification, aligning strategies with goals, and seeking professional guidance empower individuals to navigate the intricate financial landscape, paving the way for enduring financial success. Effective management of investments not only contributes to wealth building but also secures a prosperous future.