Media

We make the news for all the right reasons

If you’d like to follow our business, our growth and our key milestones, you’ve come

to the right page. These are all the reasons we make headlines regularly.

We make the news for all the right reasons

If you’d like to follow our business, our growth and our key milestones, you’ve come to the right page. These are all the reasons we make headlines regularly.

Trending

26 December 2025

India’s ultra-rich tilt 68% portfolios to growth assets as tier-2 wealth creators lead charge: Report

The country's Ultra High Net Worth Individuals (UHNIs) are channelling over 70% of their portfolios into high-growth assets like equities, alternative investments, and private markets, according to a new report from Nuvama Private. The report titled, The Exceptionals 2025, highlights a decisive shift from wealth preservation to optimization, driven by bold risk appetites and diversification strategies.

23 December 2025

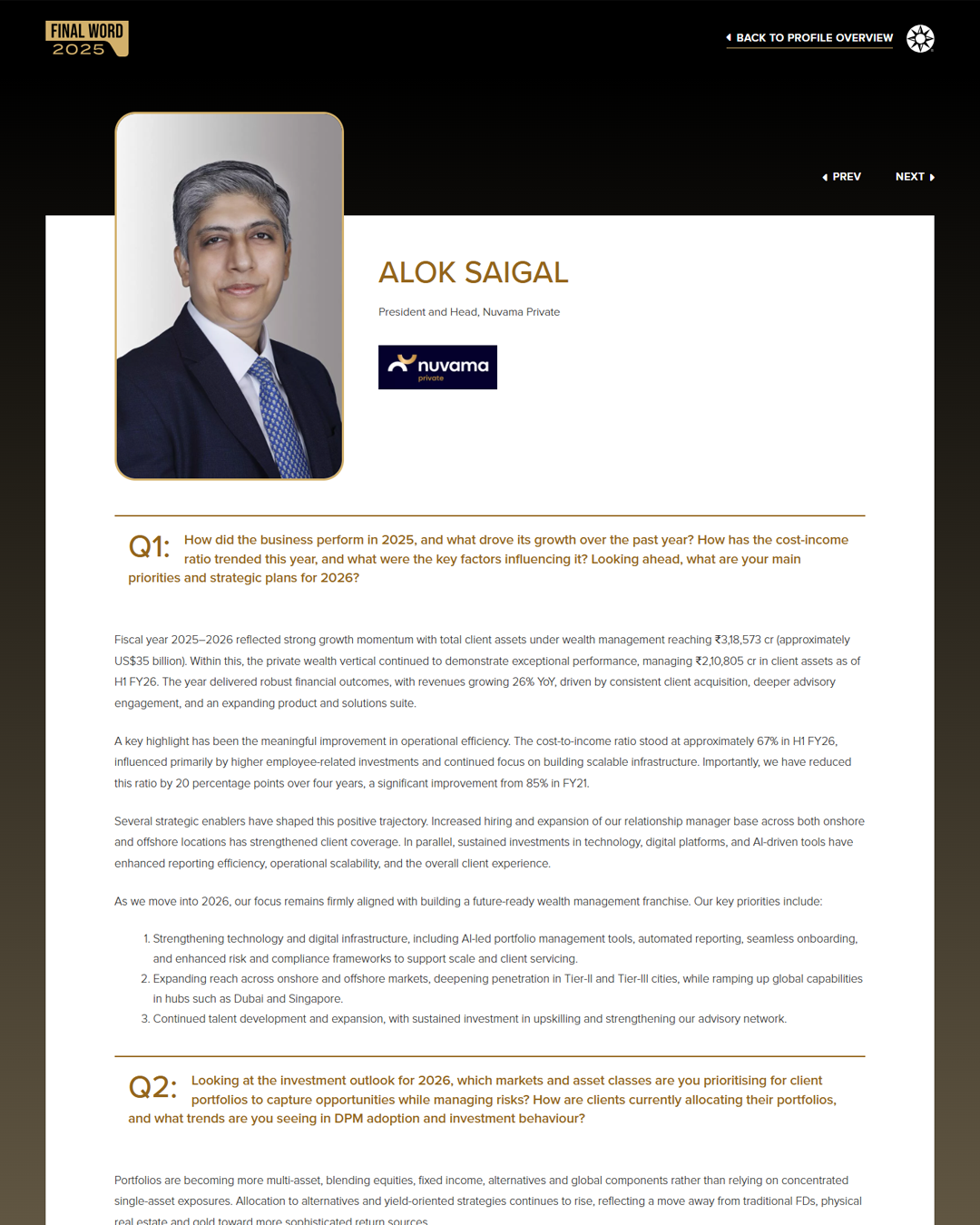

From Strategy to AI: Mapping the Road Ahead

Fiscal year 2025–2026 reflected strong growth momentum with total client assets under wealth management reaching ₹3,18,573 cr (approximately US$35 billion). Within this, the private wealth vertical continued to demonstrate exceptional performance, managing ₹2,10,805 cr in client assets as of H1 FY26. The year delivered robust financial outcomes, with revenues growing 26% YoY, driven by consistent client acquisition, deeper advisory engagement, and an expanding product and solutions suite.

24 October 2025

India’s next trillion-dollar challenge isn’t money, it’s talent: Nuvama Private

As competition intensifies and assets under management grow, the ability to attract talent and leverage technology appears increasingly crucial for firms seeking to capitalize on India's wealth management opportunity.

22 July 2025

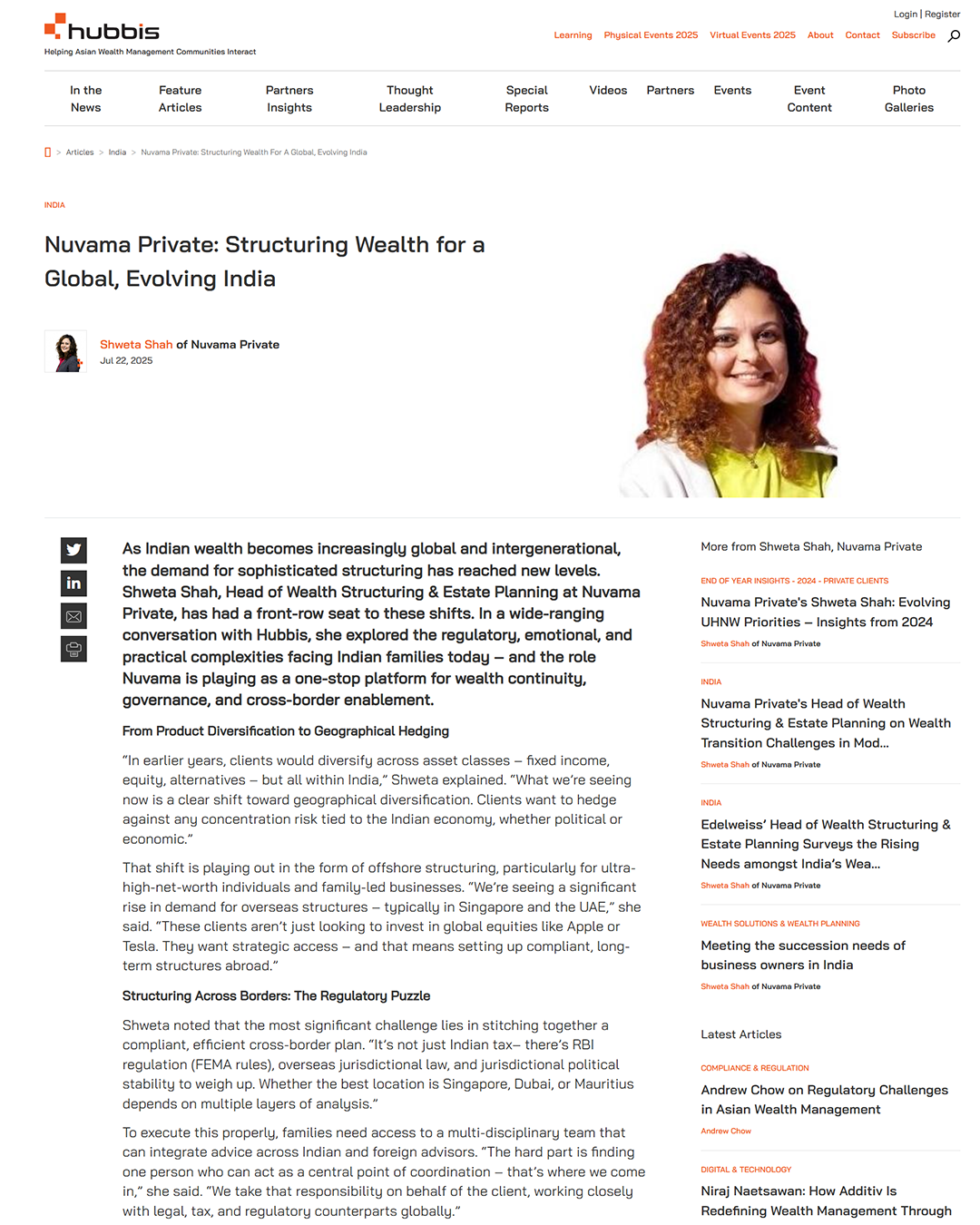

Nuvama Private: Structuring Wealth for a Global, Evolving India

As Indian wealth becomes increasingly global and intergenerational, the demand for sophisticated structuring has reached new levels. Shweta Shah, Head of Wealth Structuring & Estate Planning at Nuvama Private, has had a front-row seat to these shifts. In a wide-ranging conversation with Hubbis, she explored the regulatory, emotional, and practical complexities facing Indian families today – and the role Nuvama is playing as a one-stop platform for wealth continuity, governance, and cross-border enablement.

10 July 2025

Beyond borders: India’s Family offices going global

Overseas direct investment (ODI) isn’t just about outbound capital, it’s about inbound value. Indian entrepreneurs acquiring assets overseas aren’t exiting; they’re importing technology, accessing markets, and future-proofing domestic operations.

22 May 2025

How are NRIs looking at India as a long term investment destination? And, what are the other hot countries which they invest in?

NRIs are increasingly viewing India as a strategic long-term investment hub, driven by strong economic fundamentals, favourable demographics, and digital transformation.

According to the 2024 Knight Frank Wealth Report, over 65% of NRIs surveyed see India as a priority market for wealth allocation over the next decade. Key reasons include:

We’re covered by all major platforms

We’re covered by all major platforms