For centuries, gold has held an esteemed status as a prized possession, captivating hearts, and minds with an enduring charm that refuses to fade. Numerous factors contribute to this enduring appeal, such as its exquisite beauty, rarity, and the perceived value it embodies.

With its lustrous and captivating warm, yellow color, gold stands as a magnificent metal that is frequently intertwined with notions of opulence and luxury. Moreover, its inherent rarity adds an extra layer of allure, elevating its desirability even further. Additionally, gold is widely regarded as a secure investment, given its historical tendency to appreciate over the course of time.

In terms of quantitative research, a plethora of data substantiates the lasting appeal of gold. An illustrative example can be found in the report by the World Gold Council, which reveals that global gold demand surged to 4,630 tonnes in 2022, marking a notable 10% increase compared to the preceding year. This surge in demand can be attributed to a variety of factors, including robust investment demand and a notable rise in jewelry demand from India and China.

The below table presents the distribution of global gold demand across various sectors in the year 2022:

| Sector | Demand(Tonnes) |

|---|---|

| Jewellery | 2,897 |

| Investment | 1,431 |

| Technology | 277 |

| Central bank | 52 |

The data clearly indicates that jewelry demand holds the largest share in driving global gold demand, followed closely by investment demand. While technology and central bank demand may constitute smaller proportions, they still hold significance in shaping the demand for gold.

The gold reserves held by the Reserve Bank of India (RBI) are widely acknowledged as a secure investment. Gold, being a precious metal, has demonstrated its ability to maintain its value over an extended period. This characteristic renders gold a favorable hedge against inflation and various economic risks, further enhancing its reputation as a reliable asset.

| Year | Gold Reserves(Tonnes) |

|---|---|

| 2020 | 651.53 |

| 2021 | 706.85 |

| 2022 | 794.64 |

| 2023(till mar) | 794.64 |

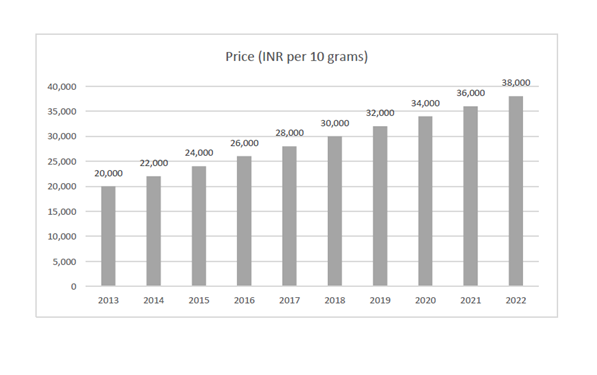

In recent years, the price of gold in India has witnessed a consistent upward trajectory. Several factors contribute to this trend, including increasing incomes, the burgeoning middle class, and a robust cultural preference for gold within Indian society. These factors collectively contribute to the sustained rise in the price of gold in India, reflecting the strong demand and significance of gold as a valuable asset in the country.

The following graph depicts the price of gold in India, measured in Indian Rupees (INR) per ten grams, spanning the past 10 years. Notably, the graph illustrates a substantial rise of over 80% in the price of gold during this period. This noteworthy increase underscores the significant growth in the value of gold over the past decade. Given the socio – economic reasons and an effective hedge for inflation, it is plausible to anticipate that the price of gold will continue its ascent in the future.